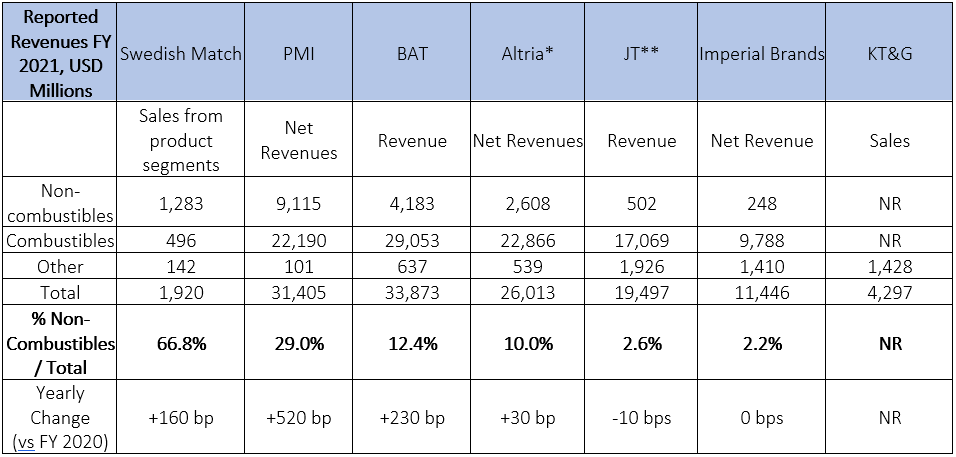

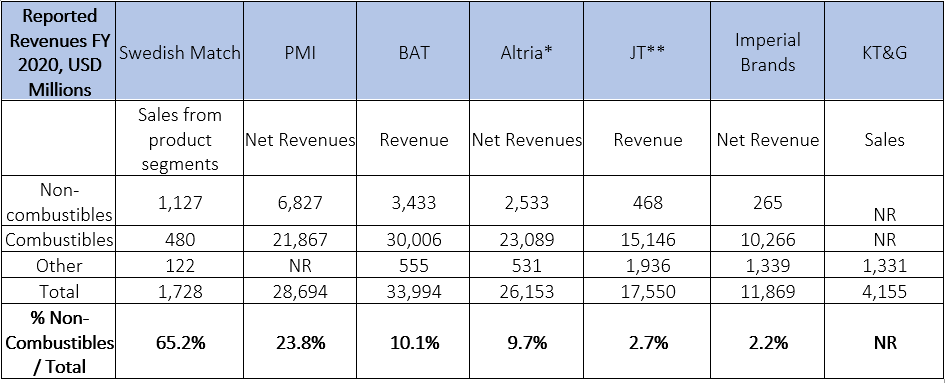

The first Tobacco Transformation Index™ found that a small group of tobacco companies made public commitments to harm reduction, but none had shifted their focus enough to ensure the accelerated decline of cigarettes and other high-risk products*. In a blog article published in September 2021, covering half-year results, we found that reduced-risk products* still formed a limited, albeit growing, share of total revenue for some of the leading tobacco manufacturers. Six months later, based on full year 2021 results, some of those companies continue to make progress. Others have stalled in their efforts toward harm reduction. Swedish Match remains the only company whose share of non-combustibles represents more than half of its total sales. In 2021, 66.8% of Swedish Match revenue came from non-combustibles (compared to 65.2% in 2020).

For 12 months ended 31st December 2021, except Imperial (12 months ended 30th September 2021)

Source: Company annual and quarterly reports (figures for Swedish Match, BAT, JT, Imperial Brands and KT&G converted to USD)

*Excludes 35% stake in JUUL; Revenue figures shown for Altria are “Net Revenues” (“Revenues net of excise taxes” were shown in H1 2021 blog post)

**JT’s non-combustible figures do not include sales outside of their domestic Japanese market

NR = Not Reported / BP = Basis Points

Based on the most recently published full year 2021 reports, Swedish Match derives most of its sales from non-combustible products (66.8%), followed by Philip Morris (29.0%), British American Tobacco (12.4%), and Altria (10.0%). Japan Tobacco and Imperial Brands lag behind with 2.6% and 2.2% share, respectively.

Two manufacturers registered ratio increases of more than 200 basis points (bp) for revenues derived from non-combustibles in 2021, compared to 2020: Philip Morris (+520 bp); and British American Tobacco (+230 bp). Swedish Match (+160 bp) also demonstrated an increase in the share of non-combustible products of total revenue, from a larger relative base, when compared to full year 2020. Notably, in late 2021 the company announced plans to spin off its cigar business and become an entirely “smokefree” company. However, on March 14th, 2022, Swedish Match announced it decided to suspend the spin-off until further notice. On the other hand, Japan Tobacco’s reported share of reduced-risk products of total revenue stalled on a year-over-year basis, while Imperial Brands regressed slightly (-10 bp).

The first Tobacco Transformation Index found that manufacturers were focusing their harm reduction investments in high-medium income countries (HMICs). Based on full year 2021 results, we are seeing some evidence of the growing availability of reduced-risk products in an increasing number of low-medium income countries (LMICs). That said, one can expect that availability of products does not necessarily correspond with sales on a proportionate basis.

Based on company reports, Philip Morris reports it has commercialized its portfolio of reduced-risk products in 71 markets worldwide, at the end of 2021, 30 of which are LMICs. For example, in 2021 Philip Morris started selling its heated tobacco products in three countries in Africa – Morocco, Tunisia and Egypt. British American Tobacco has also grown its reduced-risk geographic presence. In 2021, the company’s vapor portfolio was reportedly available in 30 markets, heated tobacco in 25 markets, and modern oral in 23 markets. These include LMICs like South Africa, Kazakhstan, Romania, Pakistan, and Indonesia. Japan Tobacco has too expanded its reduced-risk products outside of Japan. The company reports being currently present in 27 markets through its reduced-risk offer. Swedish Match is also active in multiple countries. Its reduced-risk products are available in LMICs including Malaysia and Thailand. KT&G significantly grew its reduced-risk presence in 2021 by adding multiple markets, mainly LMICs, such as Albania, Armenia, Bulgaria, Guatemala, Kazakhstan, Kyrgyzstan, North Macedonia, Malaysia, Serbia and Uzbekistan. Imperial Brands is prioritizing specific markets for each product within its reduced-risk portfolio. However, recent company reports from Imperial do not mention any LMICs in which the company offers reduced-risk products. Finally, Altria does not operate in LMICs due to its exclusive presence in North America.

A series of reports is under development, with the aim of providing a detailed analysis of company presence by product – high-risk and reduced-risk products – at the country level, within the individual country’s nicotine and tobacco regulatory context.

In addition, the second Tobacco Transformation Index in September 2022 will again rank the world’s 15 largest tobacco companies on their relative progress toward harm reduction and provide a comparison to results compiled two years ago. In this manner, the Index will bring to light, in a systematic fashion, companies’ actions over time.

* “Reduced-risk” and “high-risk” product definitions based on Relative Risk Hierarchy (RRH) produced by Rachel Murkett et al, October 2020, based on a systematic review of the scientific literature and analysis of the best available evidence.

Exchange rates taken from www.xe.com on 03.21.2022:

© 2023 Foundation for a Smoke-Free World. All rights reserved.